Discover Top Credit Unions in Wyoming: Your Overview to Financial Providers

Elevate Your Banking Experience With Cooperative Credit Union

Credit unions, with their focus on member-centric services and neighborhood participation, provide a compelling alternative to standard financial. By prioritizing private demands and promoting a sense of belonging within their subscription base, credit score unions have sculpted out a niche that resonates with those seeking an extra individualized technique to managing their financial resources.

Advantages of Cooperative Credit Union

Another benefit of credit report unions is their democratic structure, where each member has an equivalent enact electing the board of directors. This makes certain that choices are made with the most effective interests of the participants in mind, rather than concentrating exclusively on taking full advantage of earnings. Credit score unions often use financial education and therapy to assist participants improve their financial proficiency and make informed decisions regarding their money. Generally, the member-focused approach of cooperative credit union establishes them apart as organizations that focus on the well-being of their community.

Subscription Needs

Some credit unions might serve people that live or work in a specific geographical location, while others may be connected with certain business, unions, or associations. Additionally, family participants of current debt union participants are typically eligible to sign up with as well.

To end up being a participant of a cooperative credit union, individuals are typically called for to open an account and keep a minimal deposit as specified by the institution. In some situations, there might be one-time subscription charges or recurring membership charges. As soon as the subscription criteria are satisfied, people can take pleasure in the benefits of coming from a credit history union, consisting of accessibility to personalized economic solutions, competitive rates of interest, and a concentrate on member contentment.

Personalized Financial Providers

Personalized economic solutions tailored to individual demands and choices are a trademark of cooperative credit union' dedication to member satisfaction. Unlike typical banks that typically offer one-size-fits-all services, cooperative credit union take a more individualized technique to handling their members' financial resources. By comprehending the unique goals and circumstances of each member, lending institution can supply tailored recommendations on cost savings, financial investments, loans, and various other financial items.

Furthermore, cooperative credit union normally provide lower costs and competitive rates of interest on fundings and cost savings accounts, further boosting the customized monetary solutions they supply. By concentrating on private requirements and providing customized options, lending institution set themselves apart as trusted economic partners dedicated to helping participants flourish monetarily.

Neighborhood Participation and Support

Neighborhood interaction is a keystone of cooperative credit union' objective, showing their dedication to supporting neighborhood campaigns and fostering significant links. Debt unions actively take part in area events, enroller regional charities, and organize monetary literacy programs to enlighten participants and non-members alike. By buying the communities they offer, credit report unions not just reinforce their relationships but likewise contribute to the overall well-being of society.

Sustaining local business is an additional means cooperative credit union demonstrate their commitment to local neighborhoods. With using bank loan and financial advice, credit history unions assist entrepreneurs thrive and stimulate financial development in the area. This support exceeds just economic help; lending institution frequently provide mentorship and networking possibilities to aid tiny companies are successful.

Moreover, cooperative credit union regularly engage in volunteer work, urging their participants and staff members to provide back with various neighborhood solution activities - Credit Unions in Wyoming. Whether it's joining local clean-up occasions or organizing food drives, credit history unions play an energetic role in boosting the high quality of life for those in need. By prioritizing area this link involvement and support, lending institution really personify the spirit of collaboration and common support

Online Banking and Mobile Apps

In today's electronic age, modern-day banking eases have been transformed by the prevalent adoption of on the internet systems and mobile applications. Cooperative credit union are at the leading edge of this electronic change, offering members protected and practical ways to manage their financial resources anytime, anywhere. Electronic banking services given by lending institution enable members to examine account equilibriums, transfer funds, pay costs, and watch deal background with simply a couple of clicks. These systems are developed with easy to use user interfaces, making it very easy for members to browse and gain access to necessary banking attributes.

Mobile apps offered by cooperative credit union better boost the banking experience by offering added flexibility and ease of access. Participants can do various banking jobs on the go, such as depositing checks by taking a picture, obtaining account notifications, and even calling client assistance straight through the application. The security of these mobile applications is a top concern, with functions like biometric authentication and file encryption methods to guard sensitive details. Overall, lending institution' on-line financial and mobile apps equip participants to manage their funds effectively and firmly in today's fast-paced electronic world.

Verdict

In verdict, credit rating unions use an unique banking experience that prioritizes community involvement, customized solution, and participant contentment. With reduced costs, competitive rate of interest rates, and tailored monetary services, cooperative credit union accommodate individual demands and promote economic well-being. Their autonomous structure worths participant input and supports local areas with numerous initiatives. By joining a credit score union, people can raise their banking experience and construct solid partnerships while appreciating the benefits of a not-for-profit financial organization.

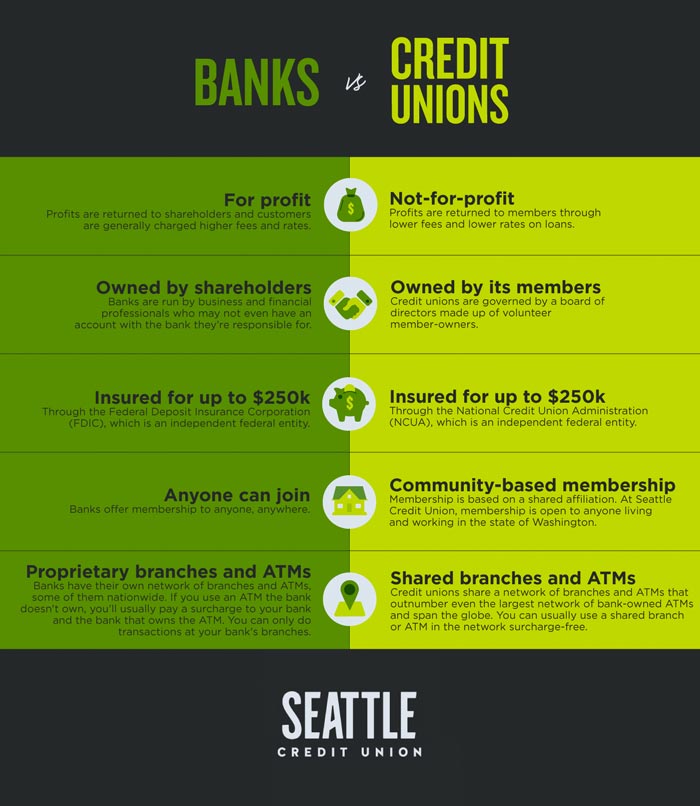

Unlike financial institutions, credit report unions are not-for-profit organizations possessed by their participants, which usually leads to lower charges and better rate of interest rates on financial savings accounts, lendings, and credit history cards. In addition, credit history unions are recognized for their personalized customer service, with team members taking the time to comprehend the special financial objectives and obstacles of each participant.

Credit scores unions often use Credit Union in Wyoming economic education and learning and counseling to help members boost their economic proficiency and make educated choices regarding their money. Some credit history unions may serve people that work or live in a specific geographical location, discover here while others may be affiliated with particular companies, unions, or associations. In addition, family participants of current debt union participants are frequently qualified to sign up with as well.